Zatca E-invoicing Software in Saudi Arabia

Bytize offers top-tier ZATCA phase 1 and phase 2 approved e-invoicing software, making it the ideal solution for your business's invoicing needs.

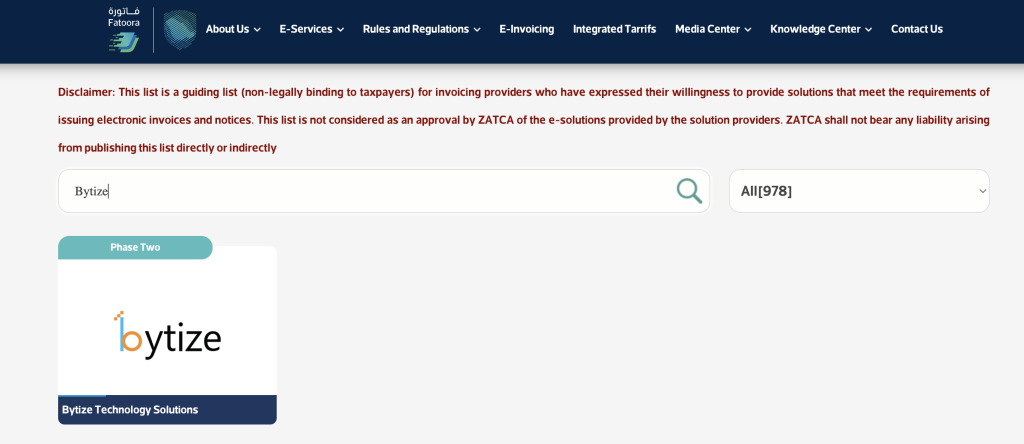

We are Zatca Approved Software

Bytize is a ZATCA-approved Phase 2 e-invoicing solution provider, ensuring compliance with both the Integration and Generation phases. Our platform meets all regulatory requirements, offering secure invoice generation, real-time validation, and seamless ERP integration.

Businesses can verify Bytize’s approval status on ZATCA’s official Solution Providers Directory: Verify Here.

Saudi Arabia's E-Invoicing Requirement

As of January 1, 2023, Saudi Arabia’s e-invoicing mandate is fully implemented. VAT-registered taxpayers are required to integrate with the ZATCA (FATOORA) platform and issue e-invoices in the specified structured format. All e-invoices must be reported and cleared with ZATCA in real time. The regulations mandate that taxpayers generate e-invoices with precise content, archive them electronically, and adhere to the prescribed guidelines. Consequently, suppliers can no longer create or store invoices in paper or PDF format.

Phases of e-invoicing in Saudi Arabia

ZATCA implemented e-invoicing in Saudi Arabia on December 4, 2021, by issuing the electronic invoicing regulation. The implementation was planned in two phases: Phase 1 and Phase 2.

Phase 1: Generation Phase

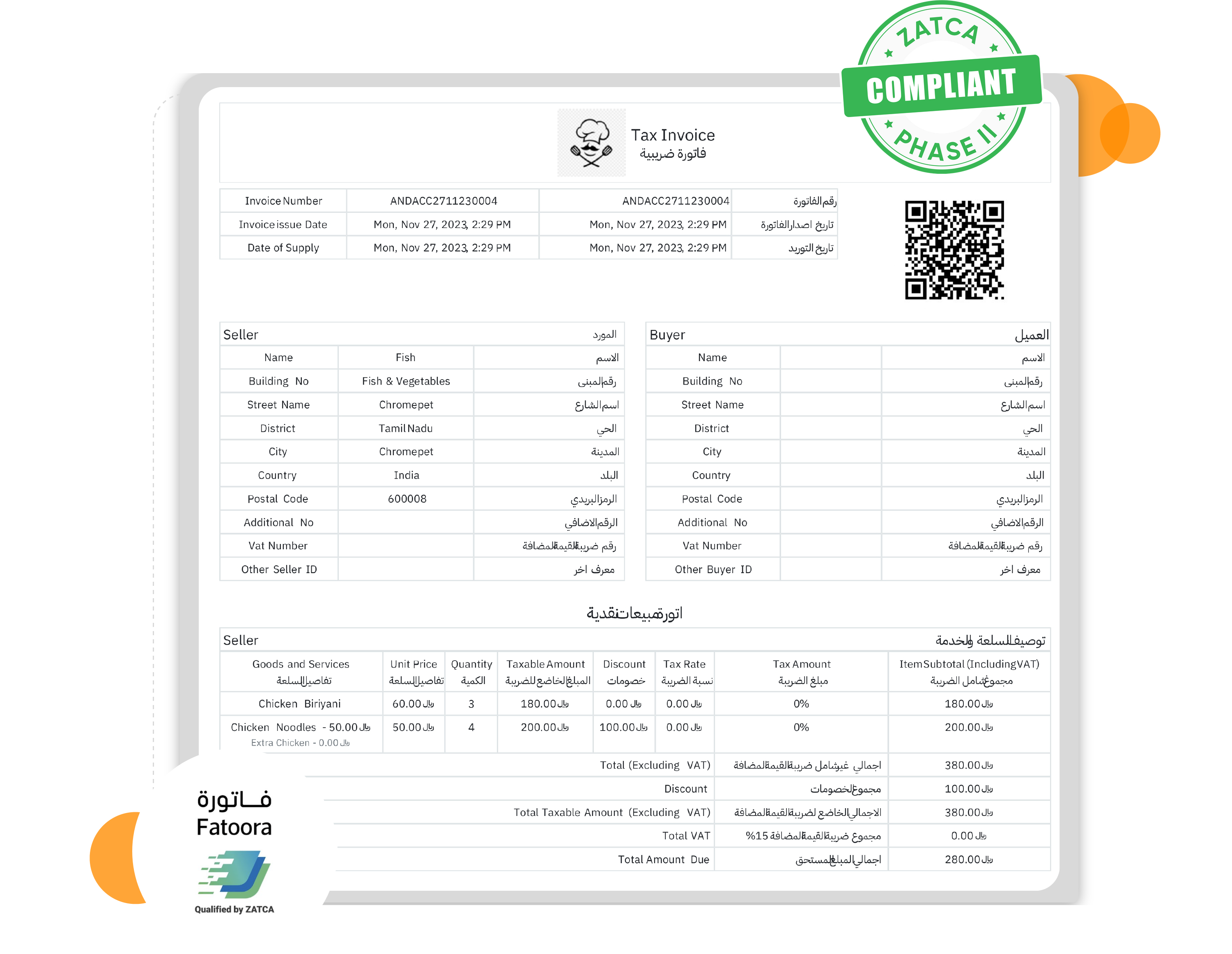

In this Generation phase, the businesses should generate and store tax invoices with QR codes

- Display QR codes on e-invoices or e-notes

- Generate UUID

- Implement mandated fields of e-invoices and associated notes

- Invoices in Arabic & English with QR code.

- Generate e-invoices for various transaction types – Sales, refund/returns, Void, etc.

Phase 2: Integrating with the ZATCA system

In this Integration phase, the businesses should generate tax invoices

- Generate QR code 9 elements

- Data validations to generate error-free invoices.

- Generates UUID & invoice hash

- XML Transmission & PDF/A3 Generation

- Cryptographic stamp

- Automatically emails the final PDF A/3 invoice to your customer.

- e-invoices data archival for up to six years on cloud servers

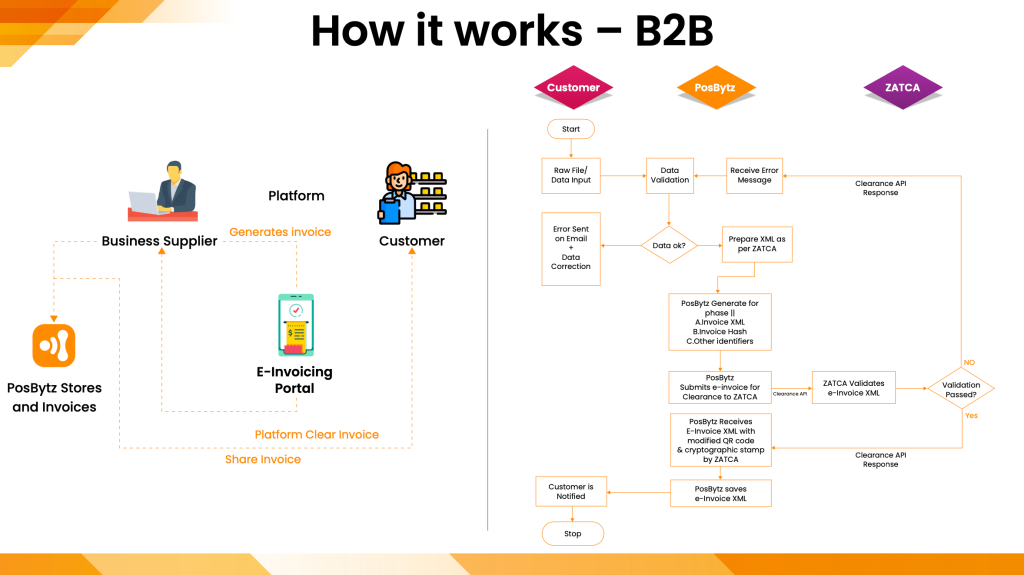

What is the process flow for phase 2 Zatca e-invoicing?

All businesses subject to e-invoicing regulations must integrate their ERP, POS, or accounting software with ZATCA’s system. According to the e-invoicing resolution, standard tax invoices must be cleared in real time, while simplified tax invoices can be reported within 24 hours of their generation.

Standard tax invoice generation flow in phase 2

Here’s the step-by-step process flow of standard tax invoices in phase II:

Step 1: First, you must generate invoices using the ERP.

Step 2: Once your EGS unit receives the invoice data, it shall generate the UUID, PIH, and ICV along with the ZATCA-compliant XML file.

Step 3: After that, the EGS unit will send the data files to the Fatoora Portal.

Step 4: If the invoice data is in valid format and complaint as per rules, ZATCA will successfully clear the invoice and places a cryptographic stamp.

Step 5: Your EGS unit receives the ZATCA cleared XML and QR code.

Step 6: Now, your EGS unit shall generate the invoice in PDF A-3 format using the data received from ZATCA.

Step 7: You must store and archive the invoices according to the ZATCA specified XML format.

Step 8: You can now share PDF A-3 (XML embedded) or XML e-invoice with your customer. However, when you are sharing the printed copy of the standard tax e-invoice, you must e-mail the XML to the buyer.

Step 9: Also, your customer can validate the standard tax e-invoice using ZATCA’s special app.

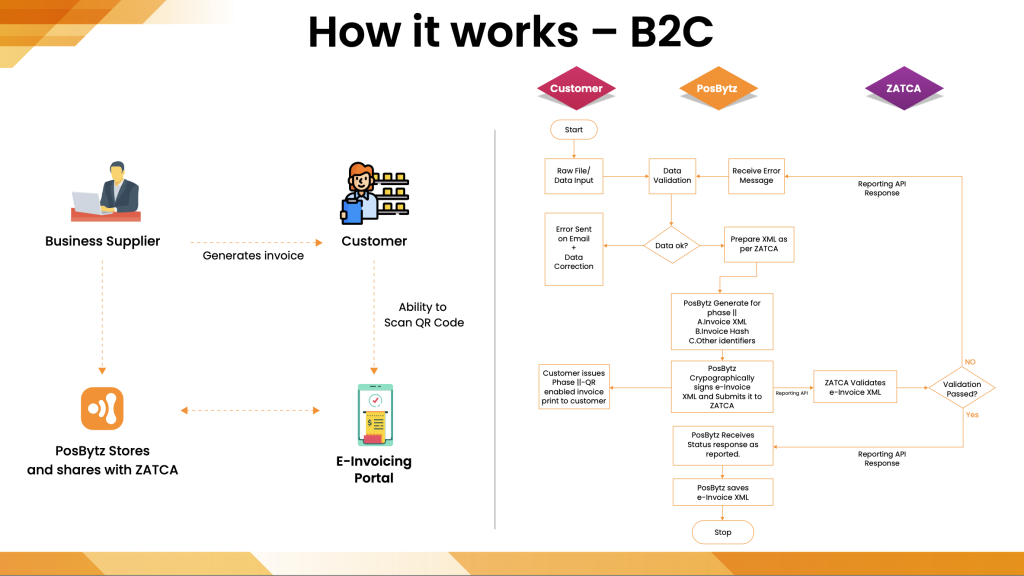

Simplified tax invoice generation flow in phase 2

Here’s the step-by-step process flow of simplified tax invoices in phase II:

Step 1: First, you must generate invoices using the ERP.

Step 2: Once your EGS unit receives the invoice data, it shall generate the UUID, PIH, and ICV. In addition, it shall generate a QR code including the details such as a cryptographic stamp, public key, etc. Your EGS unit shall also maintain the invoice counter.

Step 3: Now, you can share this simplified tax e-invoice with your customer.

Step 4: Your customer can validate the simplified tax e-invoice using ZATCA’s special app.

Step 5: Make sure to report these simplified tax e-invoices with Fatoora portal within 24 hours of generation.

Step 6: If the invoice data is in valid format and complaint as per rules, ZATCA will issue the acknowledgment validating the simplified e-invoices.

Step 7: Finally, don’t forget to store and archive invoices in ZATCA specified XML format.

Why Us?

Bytize is a trusted compliance partner for ZATCA e-invoicing, offering secure, scalable, and ZATCA-approved solutions. Our expertise ensures seamless integration with ERP systems, real-time invoice validation, and compliance with Saudi regulations. With a focus on automation, security, and efficiency, Bytize simplifies the transition to e-invoicing, minimizing risks and ensuring hassle-free compliance.

Your Compliance Partner

- Advisory & Consultancy for Compliance

- & Implementation

- Seamless & Easy Integration with ZATCA

- Highly scalable API integration

- Any ERP/POS/Accounting system

- Integration

- Data & Security – Safe & Secure

- B2B and B2C Ready

- Audit & Compliance

- Reporting & Archiving

- 24/7 – Technical Support

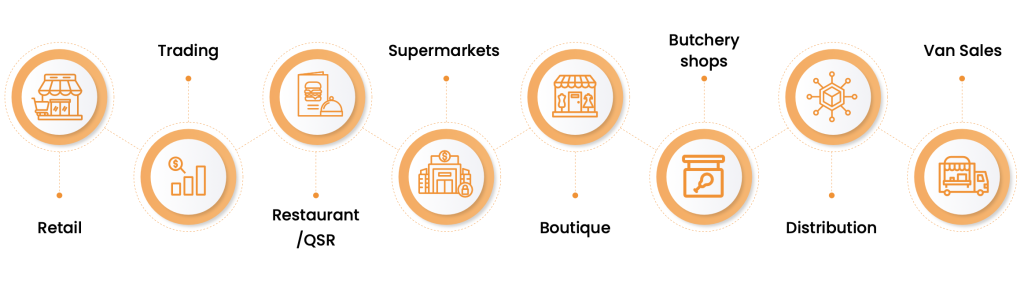

Built Integrations for all your business

Bytize can support integrating with your existing ERP , POS , Billing & Accounting software’s in ease for multiple business segments.

Microsoft Dynamics

Bytize enables smooth e-invoicing integration with Microsoft Dynamics, ensuring compliance with ZATCA regulations. Our solution automates invoice generation, validation, and submission, leveraging Dynamics’ native capabilities. With real-time data synchronization and secure API connectivity, businesses can streamline their invoicing workflow without disruptions.

Salesforce

Our ZATCA-compliant e-invoicing solution integrates seamlessly with Salesforce, automating invoice processing and submission. By leveraging Salesforce’s robust CRM data, businesses can ensure accurate, real-time invoice validation and compliance with Saudi tax regulations.

SAP

Bytize’s SAP integration simplifies ZATCA e-invoicing compliance through automated invoice generation, real-time validation, and ERP connectivity. The solution ensures seamless data flow between SAP and ZATCA’s portal, reducing manual effort and enhancing compliance accuracy.

Comprehensive API Documentation

Bytize offers a well-structured API for seamless integration with ZATCA e-invoicing. Our API provides secure endpoints for invoice generation, validation, submission, and real-time tracking. With detailed documentation, developers can easily connect their ERP or accounting systems, ensuring full compliance with Saudi regulations. The API supports XML and PDF formats, QR code embedding, and automated error handling for smooth transactions.

1 MAY 2025

Phase 2 (Integration Phase) is now underway for Wave 15 taxpayers, which includes businesses with annual revenues exceeding SAR 4 million and below SAR 5 million.

1 JUNE 2025

Phase 2 (Integration Phase) is now underway for Wave 16 taxpayers, which includes businesses with annual revenues exceeding SAR 3 million and below SAR 4 million.

1 JULY 2025

Phase 2 (Integration Phase) is now underway for Wave 17 taxpayers, which includes businesses with annual revenues exceeding SAR 2.5 million and below SAR 3 million.

How does Bytize's solution provide support?

Non-compliance will result in penalties ranging from SAR 1,000 to SAR 40,000.

Yes, ZATCA e-invoicing software can typically be integrated with popular accounting systems, simplifying the management of financial records and streamlining invoicing processes. As a approved provider of ZATCA e-invoicing solutions, we can assist you in integrating it with your existing accounting software.

Yes, data security is a top priority for us. Your data will be kept safe.

Yes, Bytize is recognized as a leading e-invoicing provider in Saudi Arabia. You can verify this on the official ZATCA page.

Bytize ZATCA certified e-invoicing solution ensures full compliance with Saudi Arabia’s regulatory requirements, covering format, content, e-signature, reporting, and clearance. Features include QR codes, UUIDs, hash chains, and legal archiving within Saudi premises, along with value-added services to enhance efficiency. All e-documents and e-invoices are exchanged securely, adhering to the Kingdom’s data and cloud computing regulations.